[最も選択された] 648 credit score credit card 211328-648 credit score credit card

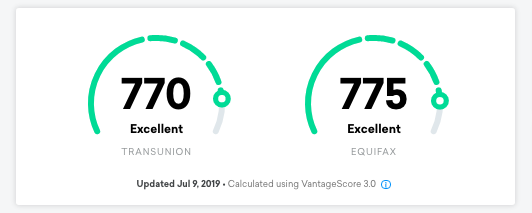

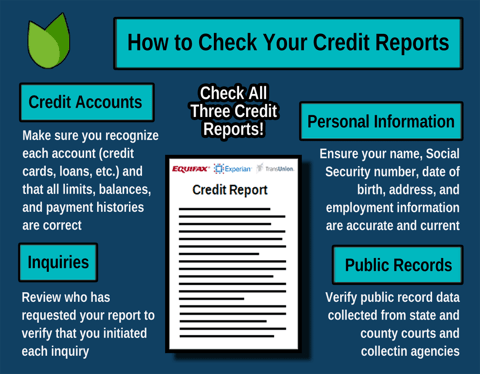

Credit Score 706 Credit Limit 1800 Age 3544 Posted 11/15 15 Overall Rating Oldest credit line is at 67 months, have around $4500 total credit line spread between 3 other cards, applied for this and was approved for the Walmart Mastercard (not the store card) instantly at $1800 limit · Generally speaking, no First, many credit cards in this credit score range don't offer balance transfers Second, the credit limit may be too low to make a balance transfer worth doing And third, your primary mission should be to pay off other debts, to lower your total amount owedThere are various types of credit scores, and lenders use a variety of different types of credit scores to make lending decisions The credit score you receive is based on the VantageScore 30 model and may not be the credit score model used by your lender

18 Best Credit Cards For 600 To 650 Credit Scores 21

648 credit score credit card

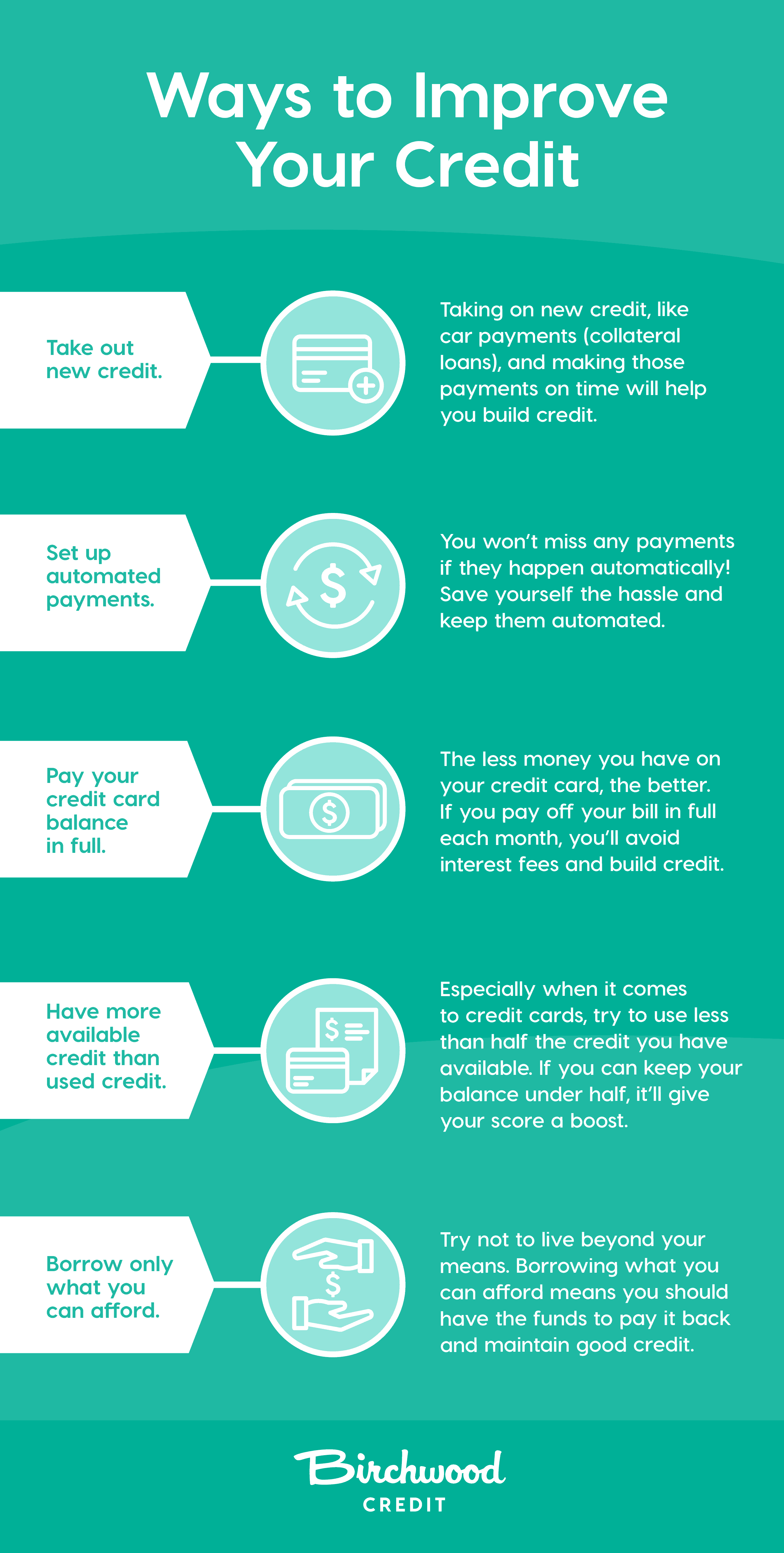

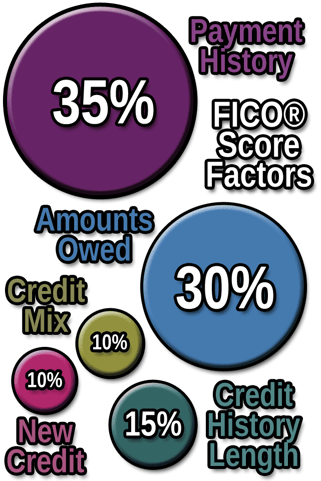

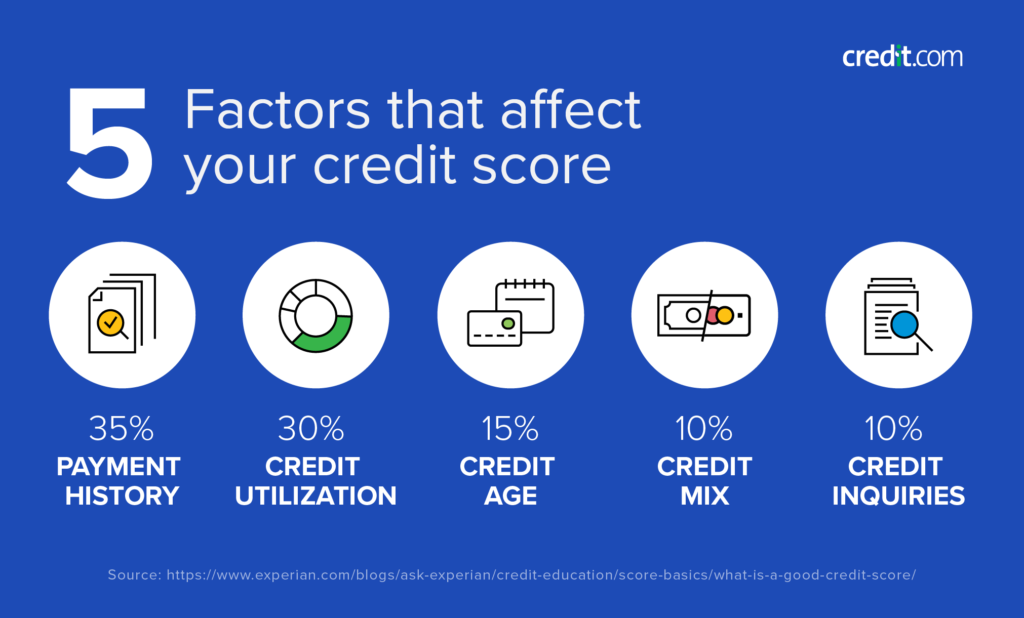

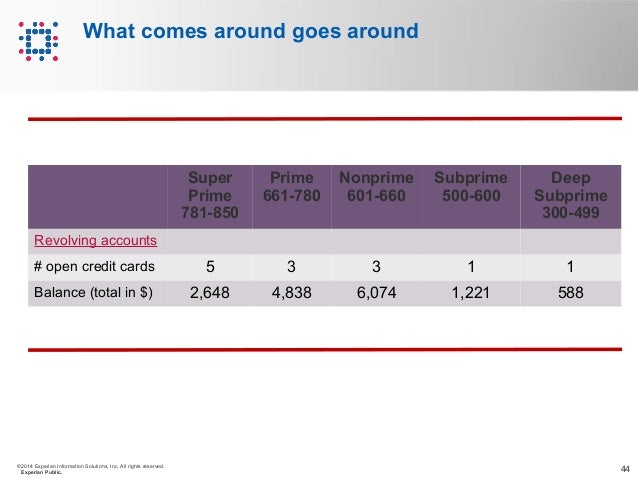

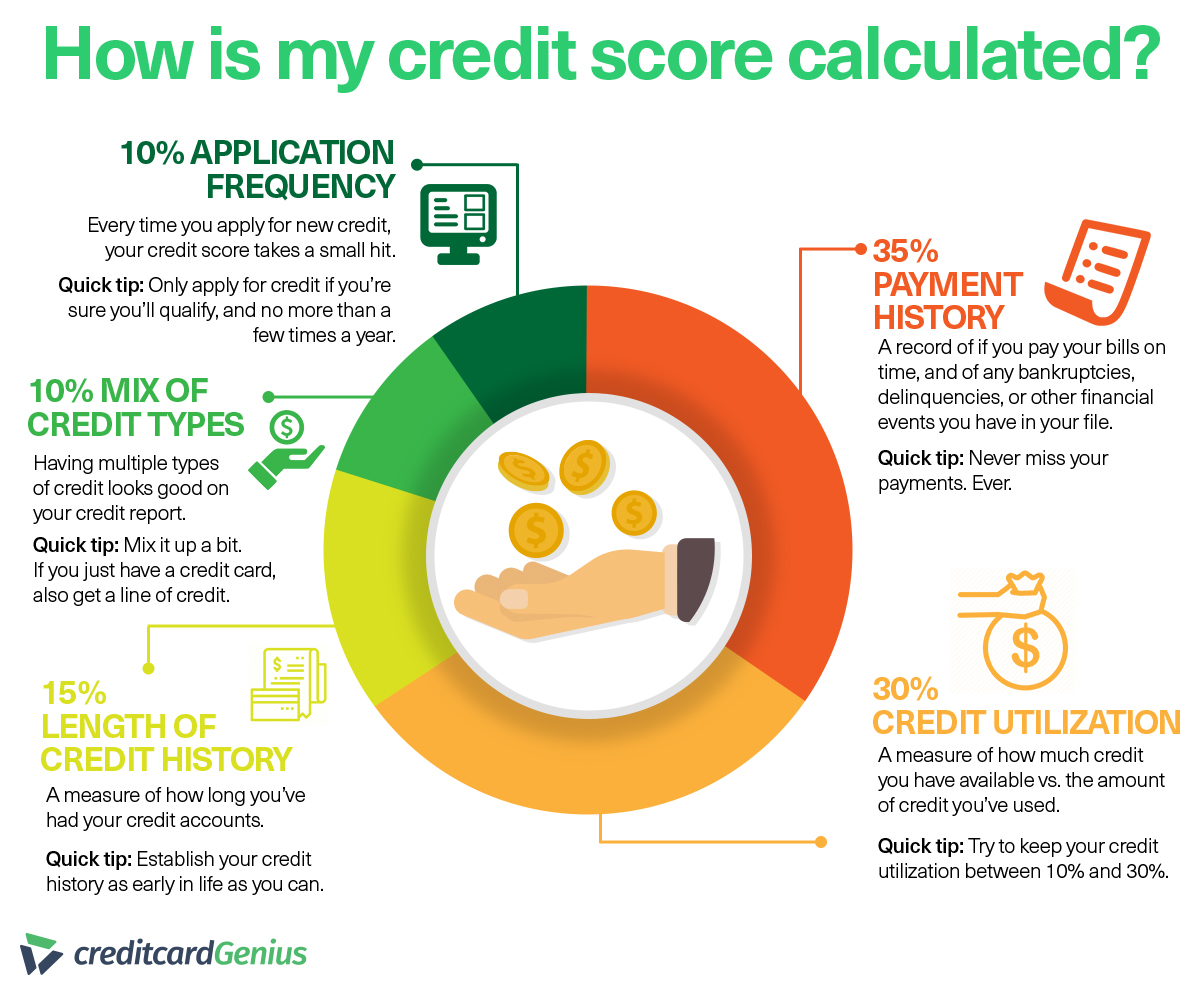

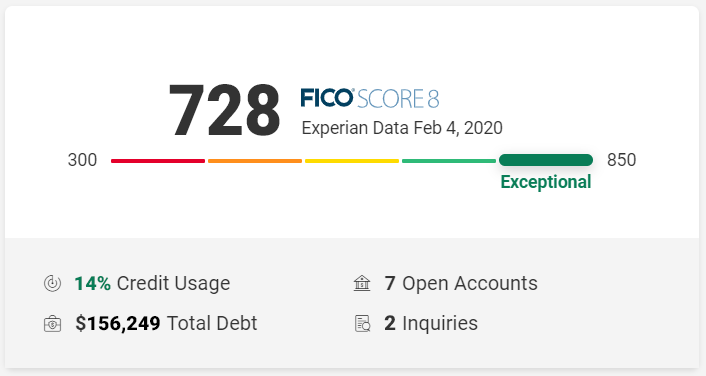

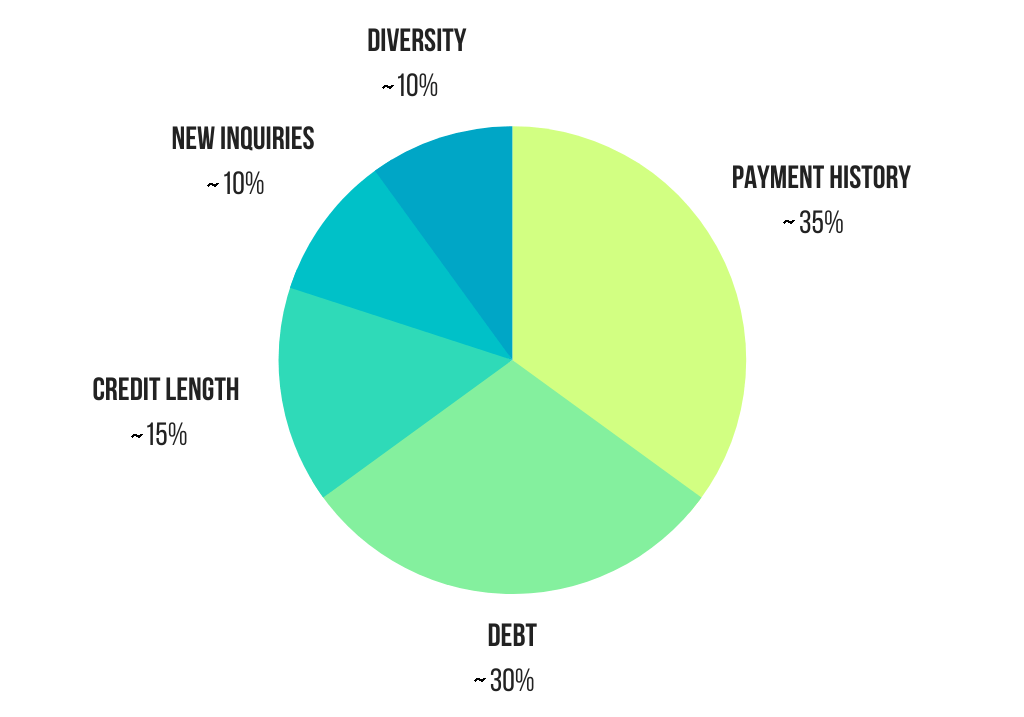

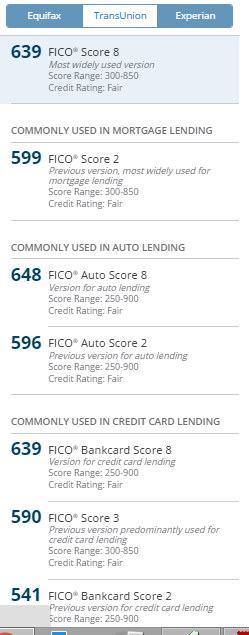

648 credit score credit card-7/11/12 · My credit score is 648 Can I still apply for a credit card?Your FICO score is essentially made up of the following * Payment History – 35% * Total Amounts Owed – 30% * Length of Credit History – 15% * New Credit – 10% * Type of Credit in Use – 10% How can I Rank My Score?

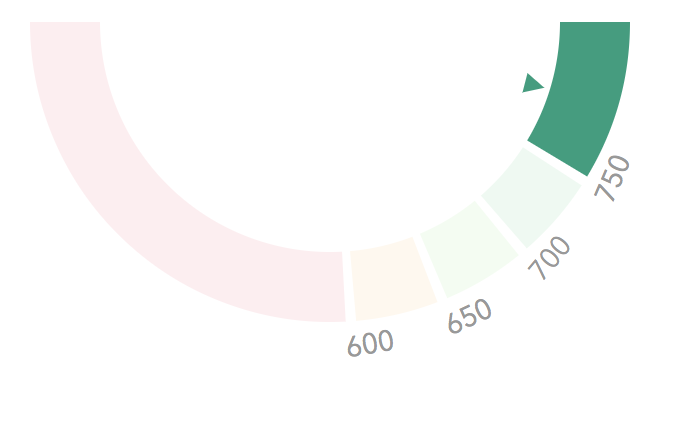

Credit Score Range What Is The Credit Score Range In Canada

· Best Credit Cards for Fair Credit – Credit Scores Advertiser Disclosure This article/post contains references to products or services · You're considered to have a good credit score in Canada if it's 660 or higher Good 660 – 724 Very Good 725 – 759 Excellent 760 – 900 If you have a good credit score in Canada, you'll have an easier time being approved for new credit such as mortgages, personal loans, lines of credit, and credit cardsFirst PREMIER® Bank Credit Card Recommended Score 501 to 660 Fill out an application and know in 60 seconds if you're approved!

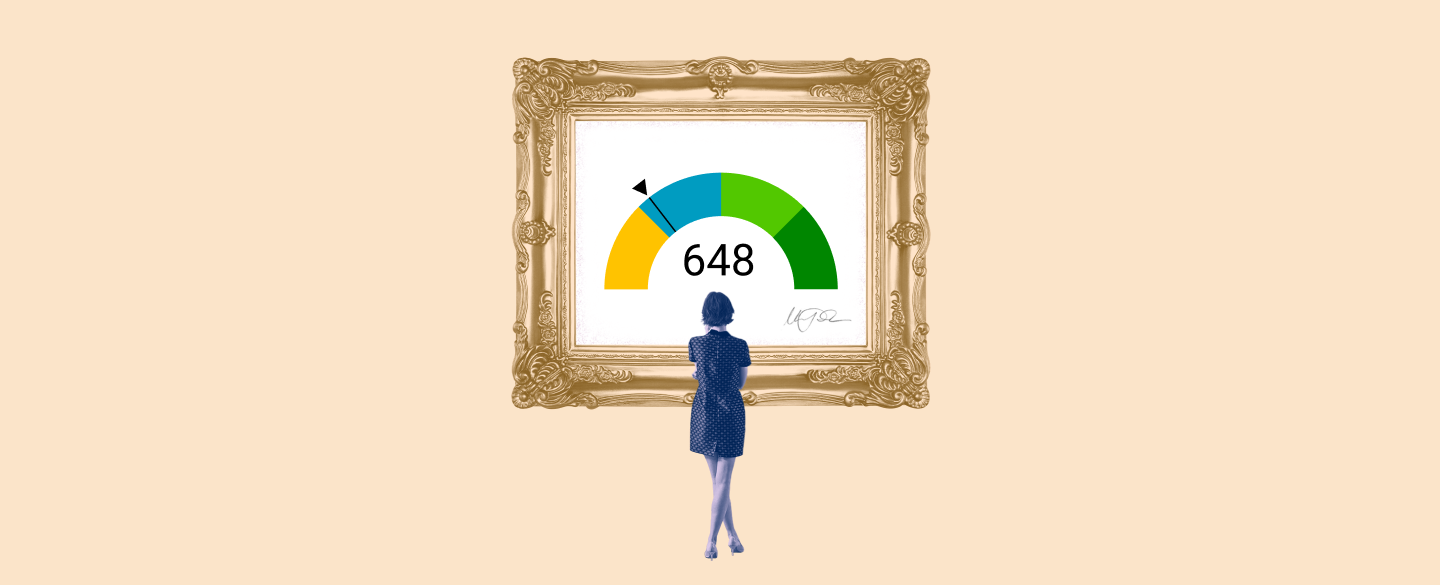

· Your credit score is a threedigit number, made up by a variety of factors, that gives lenders a snapshot into your creditworthiness In this article, we'll look at the credit score of 640, whether that's good or bad, what you can expect with that score, and more · Credit Score Requirements Credit Score requirements are based on Money Under 30's own research of approval rates;If yes, which ones do you recommend?

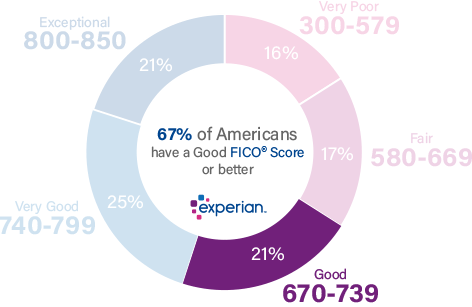

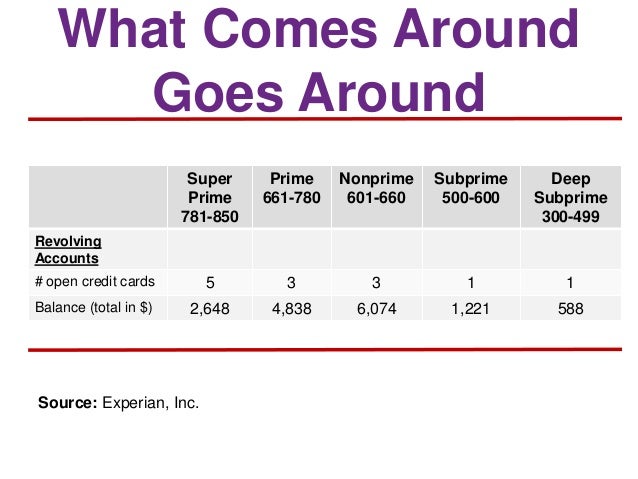

· Anyone with a credit score over 670 or higher is already at or above the national average for Americans A good credit scoring for renting is going to be less compared to a good score for buying a home So, if your renter has a score of 670 or higher, that's a very good credit score for most rentals Most landlords are looking for a scoreNow, coming to your Credit Score of 648, I bet the same is due to some defaults you have made in the recent past or some outstanding which is long due against your name Pay it ASAP by whatever means Contact the lenders and strike an agreement on the repayment mode and amountCredit Cards for 598 Credit Score Just like people with bad credit score, people whose credit score is within the range of 598 – 618 (poor credit) are also going to struggle with receiving favors from potential lenders as a result of what their credit score says about their credibility when it comes to handling financial commitments

Churning Tracking And Understanding Your Credit Score Money Metagame

Home Credit Dispute

· 1799% to 2399% Variable $0 $99 Bad/Poor/Fair/Good Credit One already has one of our top choices for credit cards for 600 to 650 credit scores But the Credit One Bank® Visa® Credit Card with Cash Back Rewards adds an extra layer of rewards to that card, offering 1% cash back on all of your purchases7 rijen · 648 Credit Score Credit Card & 649 Credit Score Credit Card By adding these tradelines to9/03/21 · Credit score needed for the Blue Cash Preferred® Card from American Express To qualify for the Blue Cash Preferred Amex card you'll need a score of at least 690 or better Like many rewards earning cards, this card requires good to excellent credit to qualify Just remember that your credit score isn't the only factor Amex will consider

Second Chance Loans Car Loans For Individuals With Bad Credit

18 Best Credit Cards For 600 To 650 Credit Scores 21

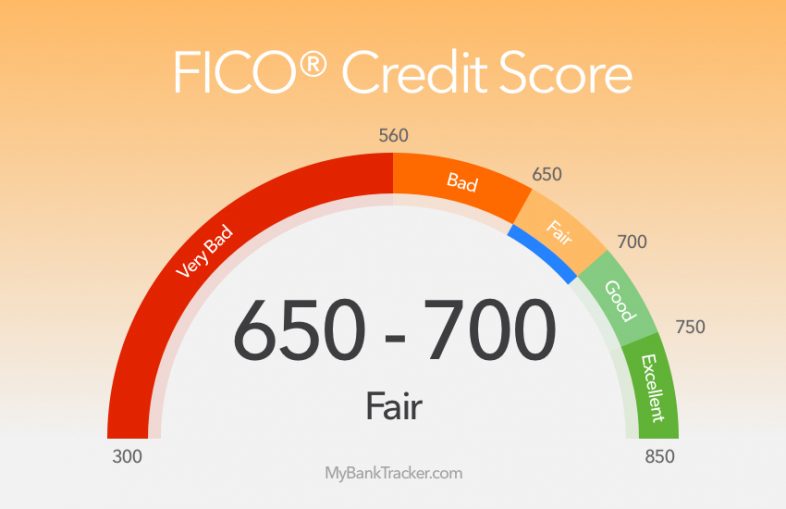

· Based on these data points, you'll generally need a credit score of 690 or higher to be approved But a few consumers reported being approved for a Delta card with a credit score as low as 640 So you may be able to snag a Delta card with a lower credit score if other aspects of your credit portfolio look appealing to AmexA 642 credit score is not a good credit score, unfortunately You need a score of at least 700 to have "good" credit But a 642 credit score isn't "bad," either It's actually in the "fair" credit tier As a result, you should be able to get a credit card or loan with a 642 credit score But a little bit of credit improvement will give youA 648 credit score is not super low, but not really high either A 648 credit score is a fair credit score No, 648 is not a bad credit score 648 is a fair credit score Someone with a credit score of 648 will probably be able to get a loan, but pay higher interest and with worse terms compared to someone with a higher credit score

648 Credit Score Good Or Bad Auto Loan Credit Card Options Guide

Our Fico Credit Score Range Guide Credit Score Chart

A 648 credit score is considered as "poor" score While people with the 648 FICO score won't have as much trouble getting loans as those with lower credit, they will face higher APR Because they are likely considered subprime borrowers, they'll be offered higher interest rates and worse terms for all credit cards and auto loansShowing 10 of 27 Results Congratulations, 27 out of 6 credit cards were successfully matched to your 648 FICO scoreUSDA Loan with 648 Credit Score The minimum credit score requirements for USDA loans is now a 640 (for an automated approval) Therefore, with a 648 credit score, you will satisfy the credit score requirements for a USDA loan Other requirements for USDA loans are that you purchase a property in an eligible area

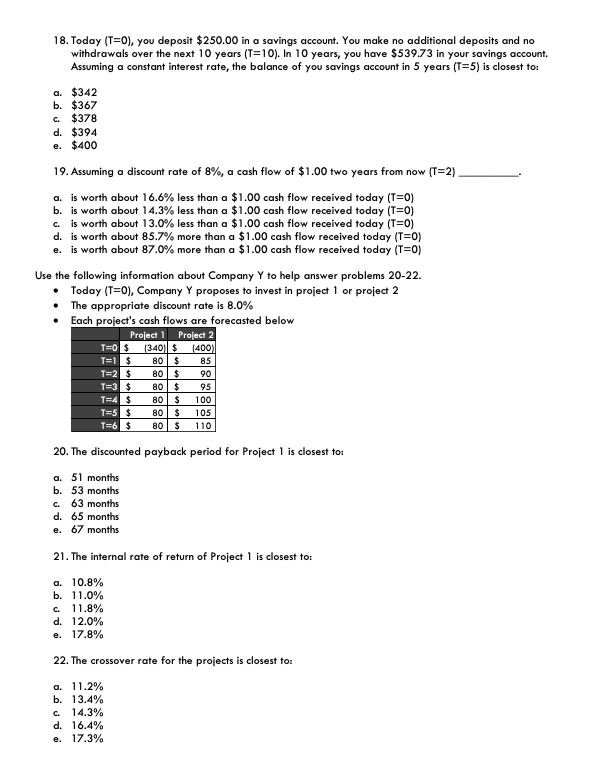

Credit Score Of 578 What It Means For Your Life Go Clean Credit

Best Credit Cards For Fair Credit In Canada For 21 Greedyrates Ca

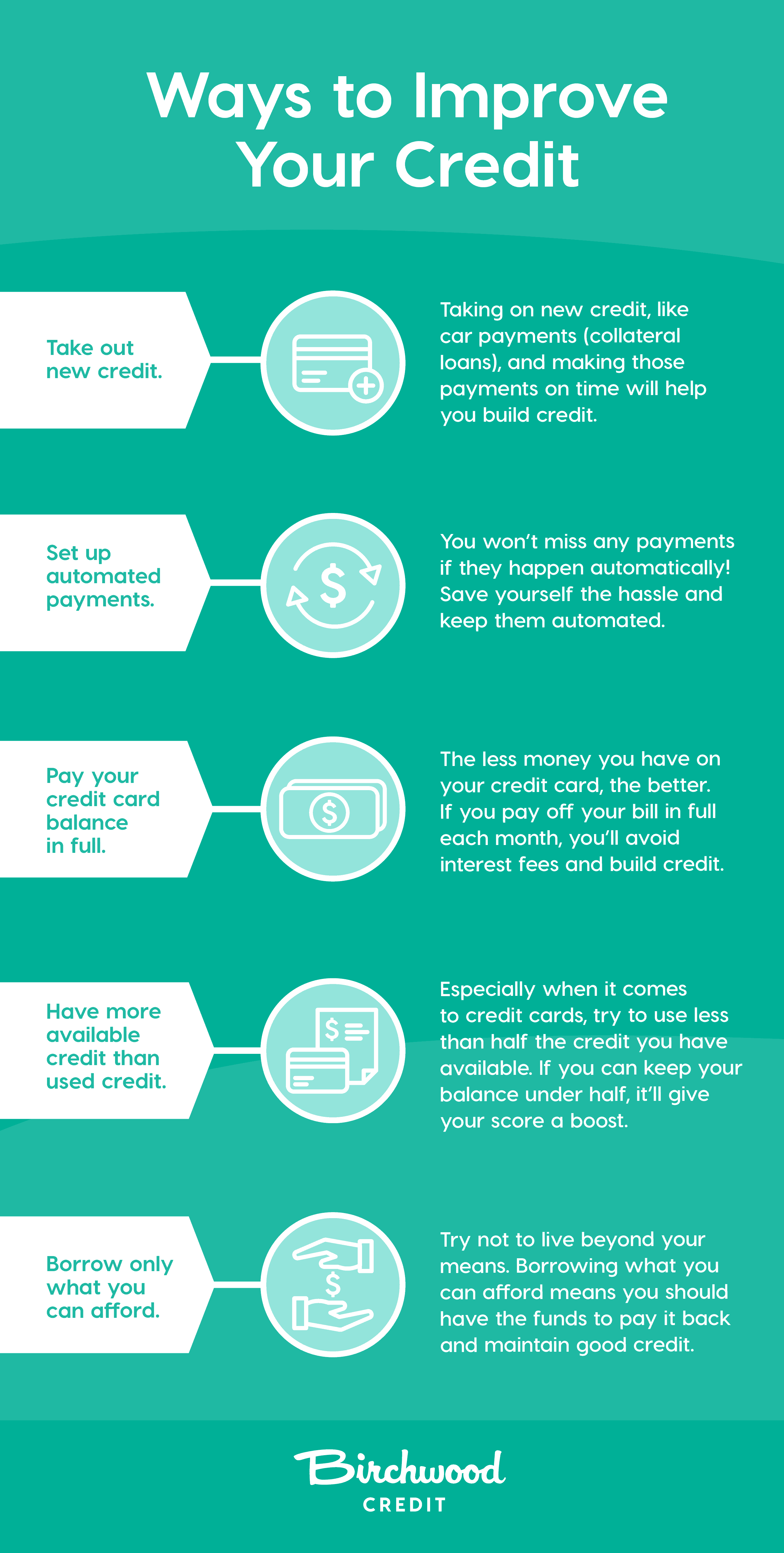

8/06/18 · The credit reports of 42% of Americans with a FICO ® Score of 648 include late payments of 30 days past due If you examine your credit report and the report that accompanies your FICO ® Score, you can probably identify the events that lowered your score As time passes, those events' negative impact on your credit score will diminishIt is necessary to take the time and look for ways you can improve your credit score so that you can enjoy the freebies which come with a new credit score Poor credit scores will limit you to the credit cards you can have In most cases, the credit card companies will consider you to be of high risk when processing the cardThey are likely to deny your card if they discover you have poorIn essence, your credit score tells you whether you have a responsible credit management and a history showing that you have been financially stable So what factors contribute to showing that you are fiscally responsible and stable?

Best Credit Cards With A 640 To 649 Credit Score For Fair Credit

Does It Matter Where You Live Average Credit Scores By State Blue Water Credit

A 648 FICO® Score is considered "Fair" Mortgage, auto, and personal loans are somewhat difficult to get with a 648 Credit Score Lenders normally don't do business with borrowers that have fair credit because it's too risky The good news?A credit score of 648 is considered poor, however, it will still get you an autoloan, some types of credit cards, a home loan and even a personal loan, especially from online lenders The score, however, will impact your finances negatively as your credit report will indicate to the lenders that you have a high risk of defaulting your debtMarketleading credit providers We work with marketleading credit providers to bring you great deals on balance transfer cards, purchase cards and reward cards We frequently show you updated offers from top credit card providers, including Capital One, MBNA, Virgin Money, HSBC and Santander Sign up to see offers

7 Best Credit Cards For Fair Credit Average Credit Of 21

Our Fico Credit Score Range Guide Credit Score Chart

· Sample Scorecard – 648 Credit Score Payment History C = 98% ontime payments Credit Utilization B = 10% 29% utilization Debt Load A = Debttoincome ratio below 028 Account Age B = Average tradeline is 7 or 8 years old Account Diversity C = 2 account types or 5 9 total accounts HardGet Free Business Credit Videos 👉 https//houstonmcmillernet/Best Chase No Credit Score Credit Card Beginner Credit Reviews 21Support The Channel===== · This card has a $2,000 credit limit Your credit utilization rate is 50% But when you transfer that $1000 balance to another card with a $3,000 credit limit, your credit utilization rate is 25% With that 25% credit utilization rate, you'll get a slight increase to your credit score

Printing A Credit Karma Credit Report Amerifund

What Is The Average Credit Score In America Credit Com

· Call or email me to discuss Complete a loan application with a local lender and see what product you qualify for there are some lenders that go as low as 550 So 648 is a nice score The lender will pull your credit and if there is anything on there that might hold it · If that family member is added as an authorized user on your account, and you both use the card responsibly for a period of time, that family member's credit scoreWhat Counts Towards Your 648 Credit Score?

Best Credit Cards For Fair Credit Score 580 669

Best Credit Cards For Credit Score 600 649 Fair Credit

· While there's no universal minimum credit score required for a car loan, your scores can significantly affect your ability to get approved for a loan and the loan terms In the second quarter of , people who got a newcar loan had average credit scores of 718 and those who got a usedcar loan had average scores of 657, according to the Q2 Experian State of the8/06/18 · Among consumers with a FICO ® Score of 658, the average credit card debt is $13,429 Payment history Delinquent accounts and late or missed payments can harm your credit score A history of paying your bills on time will help your credit score · Credit Cards for Good Credit ( Credit Score) This range includes the average US consumer credit score — 695 — but there's nothing average about the benefits that can come from these credit card offerings A good credit score helps lenders see you as an acceptable risk

All You Need To Know About A Credit Score Of 648 Creditscorepro Net

Credit Score Range What Is The Credit Score Range In Canada

· Your credit score is calculated using the information on your credit report (a record of your credit and loan accounts) and indicates the likelihood that you'll pay back money loaned to you Each month or so your credit card issuer (among a few other businesses) reports your account activity to one or more of the three major credit bureaus to be included in your creditAnd why does my score go down when I apply for a card?Is 648 a Good Credit Score?

Get Free Credit Score Online At Crif One Of The Leading Credit Information Companies In India

What Is A Good Credit Score Experian

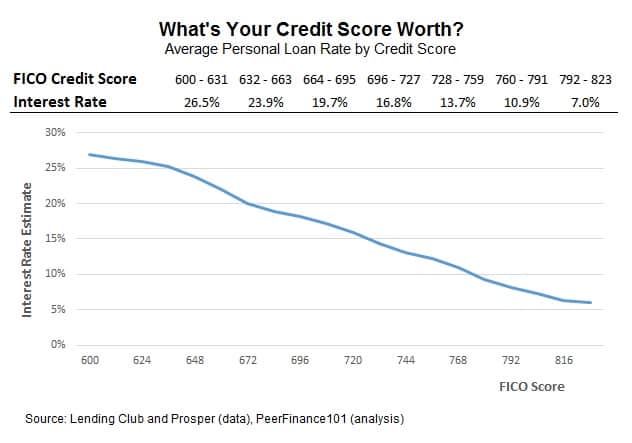

Individuals with a 648 FICO credit score pay a normal 94% interest rate for a 60month new auto loan beginning in August 17, while individuals with low FICO scores (5005) were charged 148% in interest over a similar term/08/07 · I've raised my FICO to 648 What can I expect to get in a mortgage now or should I wait until it gets to a higher number What should be my648 credit score could mean a life of outstanding credit card bills, overdue bills, late charges, penalties, eviction, denial of credit, collection agencies calling you and so on We recommend that you take a personal finance class It is going to be a long hard road to get back on your feet

18 Best Credit Cards For 600 To 650 Credit Scores 21

Amazon Launches Secured Credit Card For People With Bad Credit

BUILD CREDIT Citi ® Secured Mastercard ® is an option for customers with little or no credit history and can help you build your credit when used responsibly Unlike a debit card, Citi ® Secured Mastercard ® is a real credit card that helps build your credit history with monthly reporting to all 3 major credit bureaus Take the first step toward achieving your financial goalsScores are assigned a numeric value of between 300 and 850 · Borrowers with a FICO credit score (the score used for most consumer lending decisions) of 700 save an average of $648 in interest on their credit card, $1,392 on their car loan and $2,340 on

Hytb98vxs0uxbm

What Is The Average Credit Score In America Credit Com

The first and most critical factor will be your overall payment historyBest noannualfee credit cards The best credit cards with no annual fee give people a chance to earn rewards and build credit without breaking the bank Chase Freedom Flex℠ With no annual fee, you won't have to pay for bonus cash back Find out what others think in member reviews of Chase Freedom Flex℠Sample Quote For Credit Scores Of 640, 641, to 646, & 648 Assumes $2,000 down payment Scores sourced from Nerd Wallet site and are accurate as of 6/12/19 All loan payment amounts are based on a new car loan APR interest rate of 752% for non prime borrowers with a credit score

3

Pin On Infographics Icons Illustrations

· Credit score before Less than 500 Credit score after 785 Rock bottom "I got out of graduate school in 1998 By 1999 and 00, paying bills on time wasn't that important to me, so they'd pile up," said Seago "And I'd be 30 days late or8/09/ · A score of 600 will give you a fair chance of home loan approval although this may vary according to which bank you use A score of 670 is considered an excellent credit score, significantly boosting your chances of home loan approval Scores below 600 would be considered high to very high risk In this case you'll want to look at ways toMeeting the minimum score will give you the best chance to be approved for the credit card of your choice If you don't know your credit score, use our free credit score estimator tool to get a better idea of which cards you'll qualify for

Credit Scores What S New

1

Reports to consumer reporting agencies help you monitor financial progress Build credit with First PREMIER** Choose which account management options are right for youA score of 660 is generally considered the lowest "good" credit score A 678 is slightly higher, but you'll get better interest rates for your credit with a score in the 700s · Excellent Credit (780) With an excellent credit score of 780 or higher you will get the best rates available Very Good Credit (7 – 779) In this range you shouldn't have any problems getting good rates Good Credit (680 – 719) This is a good credit range to be in, but you won't get the very best rates on loans or credit cards

How To Improve Your Credit Score By 100 Points In 30 Days

Credit Scores How To Understand Yours Credit Karma

Credit Score In Canada What These 3 Digits Say About You Creditcardgenius

Best Credit Cards For Fair Credit In Canada For 21 Greedyrates Ca

What Are The Credit Score Requirements For An Auto Loan Credit Sesame

1

5 Top Credit Cards For Fair Credit Score Of 650 700 Mybanktracker

I Tried Experian Boost Three Times Here S How It S Helped My Credit

Car Loan Interest Rates With 648 Credit Score In 21

Credit Karma Rj3 Creative

Credit Card Money Mastering Millennial

Best Credit Cards With A 640 To 649 Credit Score For Fair Credit

What Is The Average Credit Score In The Uk Portify

Portify Build Credit Apps On Google Play

Credit Scores Ranges For All 28 Fico Scores Vantagescores

Best Credit Cards For Credit Score 600 649 Fair Credit

Best Credit Cards For Credit Score 600 649 Fair Credit

Credit Score Of 5 What You Need To Know Go Clean Credit

Best Credit Cards With A 640 To 649 Credit Score For Fair Credit

Best Credit Cards With A 640 To 649 Credit Score For Fair Credit

How Accurate Is Credit Karma We Tested It Lendedu

States Maxing Out Their Credit Cards Credit Sesame

Pin On Debit Cards

714 Credit Score Is It Good Or Bad

Credit Score In Canada What These 3 Digits Say About You Creditcardgenius

Fico Score The Score That Lenders Use

What Credit Score Is Needed For An American Express Credit Card Mybanktracker

Synchrony Bank Fico Score Disclosure Myfico Forums

Our Fico Credit Score Range Guide Credit Score Chart

What Credit Score Do I Need To Get A Credit Card

How Do You Check Your Credit Score Experian

Credit Score Needed For Amex Credit Cards

High Interest Rate Investments In The Low Interest Rate Environment

Credit Score Range What Is The Credit Score Range In Canada

Eight Surprising Ways To Raise Your Credit Score Csmonitor Com

8 Best Loans Credit Cards 600 To 650 Credit Score 21

What Is The Minimum Credit Score For A Home Loan In South Africa Mortgagemarket

How The Racist Credit Score System Can Ruin Lives

648 Credit Score Good Or Bad Auto Loan Credit Card Options Guide

Best Credit Cards For Credit Score 600 649 Fair Credit

13 You Owe Your Credit Company 25 000 And Plan To Chegg Com

What Is A Good Credit Score Nerdwallet

How To Change Your Credit Card Due Date Credit Card Insider

Peer Graded Assignment Part 5 Modeling Credit Card Default Risk And Customer Profitability Test Set Receiver Operating Characteristic

Credit Score Basics 04 17

Best Credit Cards With A 640 To 649 Credit Score For Fair Credit

Mcgrath Pink Visa Low Interest Rate Credit Card Community First Credit Union

Cibil Score For Credit Card Minimum Credit Score Required For Credit Cards

My Credit Score Went From 428 To Today 648 In 2 Years All I Did Was Dispute Dispute Dispute No Actual Letters Sent Credit

Surge Mastercard Credit Card Review

629 Credit Score Is It Good Or Bad

What Your Credit Score Range Really Means In Canada Loans Canada

Australia S Regional Generational Credit Score Trends

Best Credit Cards For Fair Average Credit Of 21 Creditcards Com

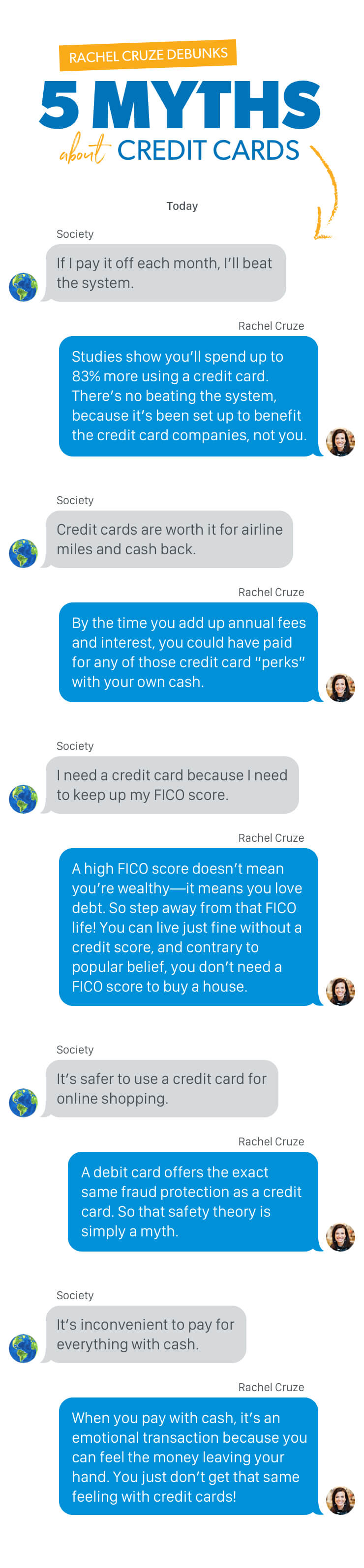

Your Top Credit Card Debt Questions Answered Ramseysolutions Com

How Credit Scores Work Your Guide Student Loan Hero

648 Credit Score What Does It Mean Credit Karma

3

How Do I Get My Credit Score Above 700 Experian

Best Credit Cards With A 640 To 649 Credit Score For Fair Credit

Best Credit Cards For Credit Score 600 649 Fair Credit

What Is A Good Credit Score Nerdwallet

Can Paying For Bail With A Credit Card Hurt My Credit Score Orange County Bail Bondsman Santa Ana Bail Bonds

Best Credit Cards For Fair Credit Score 580 669

How To Use Credit Karma S Credit Score Simulator Youtube

Next App Highest Score 639 Fico 08 Ex Myfico Forums

The Credit Card Act And Consumer Debt Structure Semantic Scholar

Your Credit Score And Bankruptcy What You Need To Know Cope Law

Best Credit Cards For Fair Credit In Canada For 21 Greedyrates Ca

Best Credit Cards For Credit Score 600 649 Fair Credit

Top 5 Websites To Check Your Credit Score For Free

What Credit Score Do You Need To Get A Car Loan

600 Credit Score Car Loans 21 Badcredit Org

/article-new/2020/02/apple_card_ofx.jpg?lossy)

Apple Card All The Details On Apple S Credit Card Macrumors

What Is The Average Canadian Credit Score Borrowell

Credit Score Guide How To Get The Financial Respect You Deserve

コメント

コメントを投稿